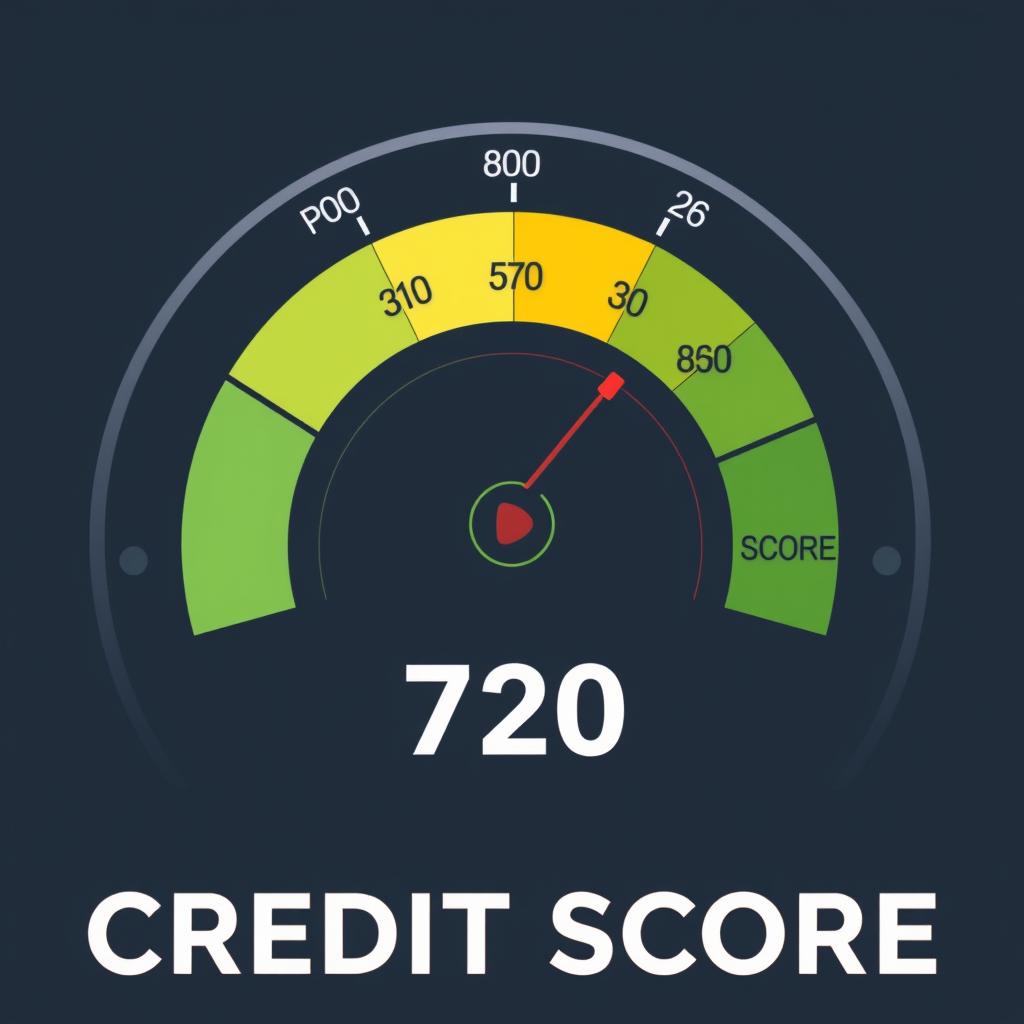

Your credit score is more than just a number—it’s a key factor in your financial health that affects everything from loan approvals to interest rates. With identity theft and credit fraud on the rise, regularly monitoring your credit score has never been more important. IdentityIQ offers a comprehensive solution that goes beyond free credit checks, providing advanced monitoring, identity protection, and personalized insights to help you take control of your financial future.

Why Regularly Checking Your Score Matters

Your credit score impacts nearly every aspect of your financial life. Lenders, landlords, and even employers use this three-digit number to make decisions about you. Regular monitoring helps you:

- Detect identity theft early before significant damage occurs

- Spot errors on your credit report that could be lowering your score

- Understand how your financial decisions affect your creditworthiness

- Prepare for major purchases like homes or vehicles by improving your score

According to the Federal Trade Commission, one in five Americans has an error on their credit report that could affect their score. Without regular monitoring, these errors could cost you thousands in higher interest rates or even lead to loan denials.

Don’t Wait Until It’s Too Late

Take control of your credit health today with IdentityIQ’s comprehensive monitoring service.

Introducing IdentityIQ: Your Trusted Credit Monitoring Partner

IdentityIQ stands out in the crowded credit monitoring market by offering comprehensive protection that goes beyond basic credit reports. With advanced algorithms and real-time alerts, IdentityIQ helps you stay informed about changes to your credit profile while protecting your identity from potential threats.

Unlike free credit monitoring services that provide limited information and minimal protection, IdentityIQ delivers a complete suite of tools designed to safeguard your financial reputation and personal information.

Key Features of IdentityIQ’s Credit Monitoring Service

IdentityIQ offers a comprehensive suite of tools designed to help you monitor your credit score, protect your identity, and take control of your financial health.

Complete Credit Monitoring

Access and monitor your credit reports from all three major bureaus—Equifax, Experian, and TransUnion—in one convenient location. Receive alerts about changes to your credit file so you can take immediate action.

Identity Theft Protection

Protect your personal information with advanced identity monitoring that scans the dark web for your data. Receive instant alerts if your information is compromised, allowing you to respond quickly to potential threats.

Score Improvement Tools

Receive personalized recommendations to improve your credit score based on your unique credit profile. Understand exactly what factors are affecting your score and learn specific actions you can take to raise it.

Special Offer: Use Code 431272LR

Sign up today using offer code 431272LR to receive our premium credit monitoring package at a special introductory rate. This limited-time offer includes enhanced identity theft insurance and priority customer support.

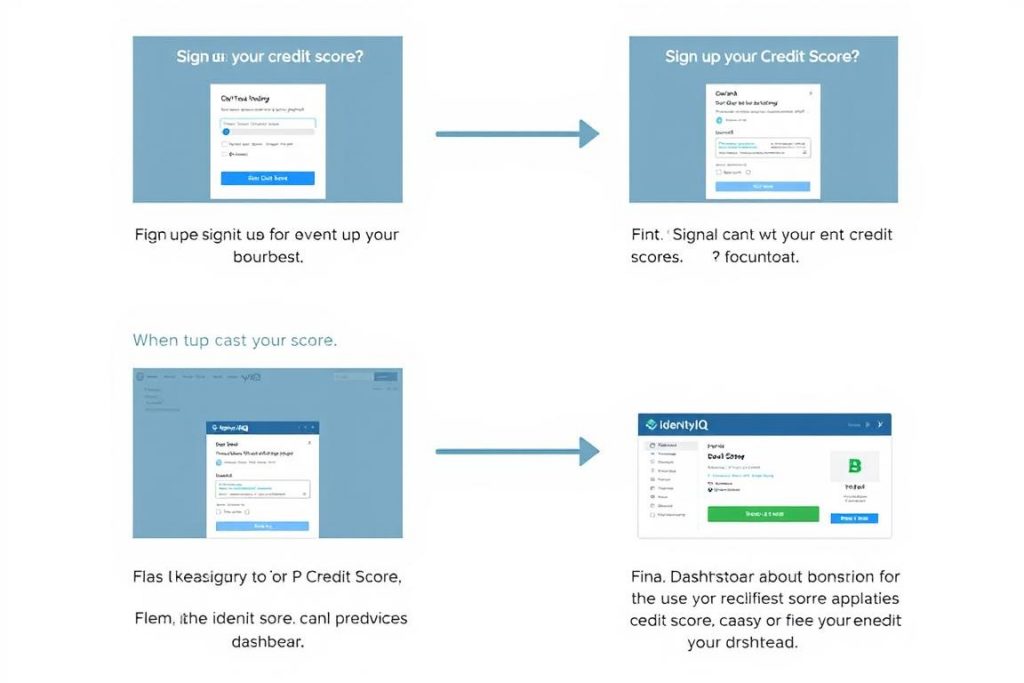

How to Check Your Score with IdentityIQ

Getting started with IdentityIQ is quick and easy. Follow these simple steps to begin monitoring your credit score and protecting your identity:

- Visit the secure portal – Go to IdentityIQ’s secure portal using the special offer link.

- Create your account – Enter your basic information and create secure login credentials.

- Verify your identity – Complete the verification process to ensure your information stays protected.

- Access your dashboard – Once verified, you’ll gain immediate access to your credit scores and monitoring tools.

- Set up alerts – Customize your notification preferences to stay informed about changes to your credit.

Secure Login Process

IdentityIQ uses bank-level encryption and multi-factor authentication to keep your personal information safe. Your data is protected with the same security standards used by major financial institutions.

Why Choose IdentityIQ Over Free Credit Score Services

While free credit score services provide basic information, IdentityIQ offers comprehensive protection and monitoring that gives you complete visibility into your credit health.

| Features | Free Credit Services | IdentityIQ |

| Credit Bureau Coverage | Usually only 1 bureau | All 3 major bureaus |

| Score Update Frequency | Monthly or less | Daily monitoring |

| Identity Theft Protection | Limited or none | Comprehensive protection |

| Credit Report Access | Limited information | Complete reports |

| Score Improvement Tools | Basic suggestions | Personalized recommendations |

| Customer Support | Limited or automated | Dedicated support team |

What to Do After You Check Your Score

Checking your credit score is just the first step toward better financial health. Here’s what to do after you review your score with IdentityIQ:

If Your Score Needs Improvement:

- Review your credit reports for errors and dispute any inaccuracies

- Pay down existing debt, focusing on high-interest accounts first

- Make all payments on time to build a positive payment history

- Keep credit card balances low, ideally below 30% of your credit limit

- Follow IdentityIQ’s personalized recommendations for your specific situation

If Your Score Is Good:

- Continue monitoring regularly to maintain your positive status

- Set up alerts to be notified of any suspicious activity

- Consider applying for better credit terms on existing accounts

- Review identity protection reports to ensure your information is secure

- Explore IdentityIQ’s advanced features to further strengthen your credit profile

“Regularly checking my score with IdentityIQ helped me identify a fraudulent account that I wouldn’t have caught otherwise. Their instant alerts allowed me to take action before any serious damage was done to my credit.”

Frequently Asked Questions About Checking Your Score

Will checking my own credit score lower it?

No. When you check your own credit score through IdentityIQ, it’s considered a “soft inquiry” and doesn’t affect your score. Only “hard inquiries” made by lenders when you apply for credit can temporarily lower your score.

How often should I check my credit score?

With IdentityIQ, you can check your score as often as you like without any negative impact. We recommend reviewing your score at least monthly to stay informed about your credit health and catch any issues early.

How is IdentityIQ different from free credit score services?

Unlike free services that typically show scores from only one bureau and offer limited monitoring, IdentityIQ provides comprehensive three-bureau monitoring, identity theft protection, personalized improvement recommendations, and dedicated customer support.

What information do I need to provide to check my score?

To verify your identity and access your credit information, you’ll need to provide basic personal information including your name, address, date of birth, and Social Security number. IdentityIQ uses bank-level encryption to keep this information secure.

Take Control of Your Credit Health Today

Your credit score is too important to leave to chance. With identity theft on the rise and credit reporting errors affecting millions of Americans, regular monitoring is essential for your financial wellbeing. IdentityIQ provides the comprehensive tools and protection you need to check your score, monitor your credit, and safeguard your identity.

Don’t wait until a problem appears on your credit report to take action. By then, the damage could already impact your financial options and cost you thousands in higher interest rates or denied applications.

Ready to Check Your Score?

Sign up today using special offer code 431272LR and take the first step toward better credit health and identity protection.